Table Of Content

By receiving both estimates, you’ll have the benefit of a reliable estimated range you can expect your home value to fall within. Additional research will include a comparison of other similar homes that have been sold recently (known as "comps"). You can also try presenting a factual case for a higher valuation to the original appraiser.

My home is located in one of the areas covered, so why isn’t there a Redfin Estimate for it?

You can compare valuations to a seller’s listing price or keep an eye on a specific neighborhood that you wish to move to in the future. Whether you’re thinking about selling or refinancing your current home, or buying a new one, it’s important to know how a property is valued in today’s market. For your current home, you’ll have a good estimate of how much you may receive from a buyer, or how much equity you may be able to borrow against after an appraisal. If you’re shopping for a home, you’ll be able to estimate your homebuying budget and find great prospects to match. It will also be useful to check other similar homes in the area to make sure your offer is competitive.

Reasons To Move to Irvine, CA, and Why You’ll Love Living Here

The contingency protects you from paying too much for a house that’s worth less than it’s being sold for. If you’re getting an appraisal because you’re ready to buy a new home or refinance your current home, take a look at SoFi. Our mortgage loans have competitive rates, and qualifying first-time homebuyers can put as little as 3% down. The cost of a home appraisal covers things like the appraiser’s training, licensing, insurance, and expertise. It also covers the time it’ll take for the appraiser to assess nearby sales and market trends as well as conduct a visual inspection. If you think it’s time to refinance and are getting an appraisal done, it shows the home mortgage lender that you, the borrower, aren’t receiving more money from them than the home is actually worth.

How long does the appraisal process take?

For instance, you can spruce up your curb appeal, make sure the house is clean and tidy, and take care of any light repairs, cosmetic issues, and routine maintenance items. It will take the appraiser an average of seven to 10 days to look at the property, complete the research process, prepare the appraisal report and deliver it. If a bad appraisal is standing between you and your home purchase or sale, consider getting a second opinion by bringing in another appraiser. Appraisers can make mistakes or have imperfect information, and appraisals can be affected by bias. Chances are that neither you nor the seller wants the transaction to fall through. As the buyer, you have an advantage in that a low appraisal can serve as a negotiating tool to convince the seller to lower the price.

The underwriter reviews the entire loan file to make sure everything is in order and that all the required documents have been submitted. If all goes well, the appraisal gets slipped into the pile of paperwork and the closing process takes one step forward. Getting an appraisal is a required step when giving a home to a family member as a gift of equity. Lenders want to make sure that homeowners are not overborrowing because the home serves as collateral for the mortgage.

Can I see what my home is worth even if I’m not selling?

A lender will select a home appraiser who will contact the seller to set a time and date for a home visit. The mortgage lender wants proof that the amount of the loan they’re approving and lending to the homebuyer does not exceed the fair market value of the home. Or they will end up taking on more risk in the event the homebuyer defaults on their loan payments and go into bankruptcy. In this instance, the lender might not be able to sell the home for the same amount of money it loaned the homebuyer and would lose money. While appraisers will overlook the “lived-in look” of a home, decluttering can make their job more accessible since the appraiser will take pictures and measurements during the appraisal process.

The number of rooms, square footage, location, neighborhood, and other elements will all factor into determining your home’s value. The appraiser will also make adjustments from home to home based on each property’s characteristics compared to the subject property being appraised. In addition to curb appeal, a home appraiser will also review your home’s exterior to ensure its structurally sound.

Home Appraisal Vs. Home Inspection

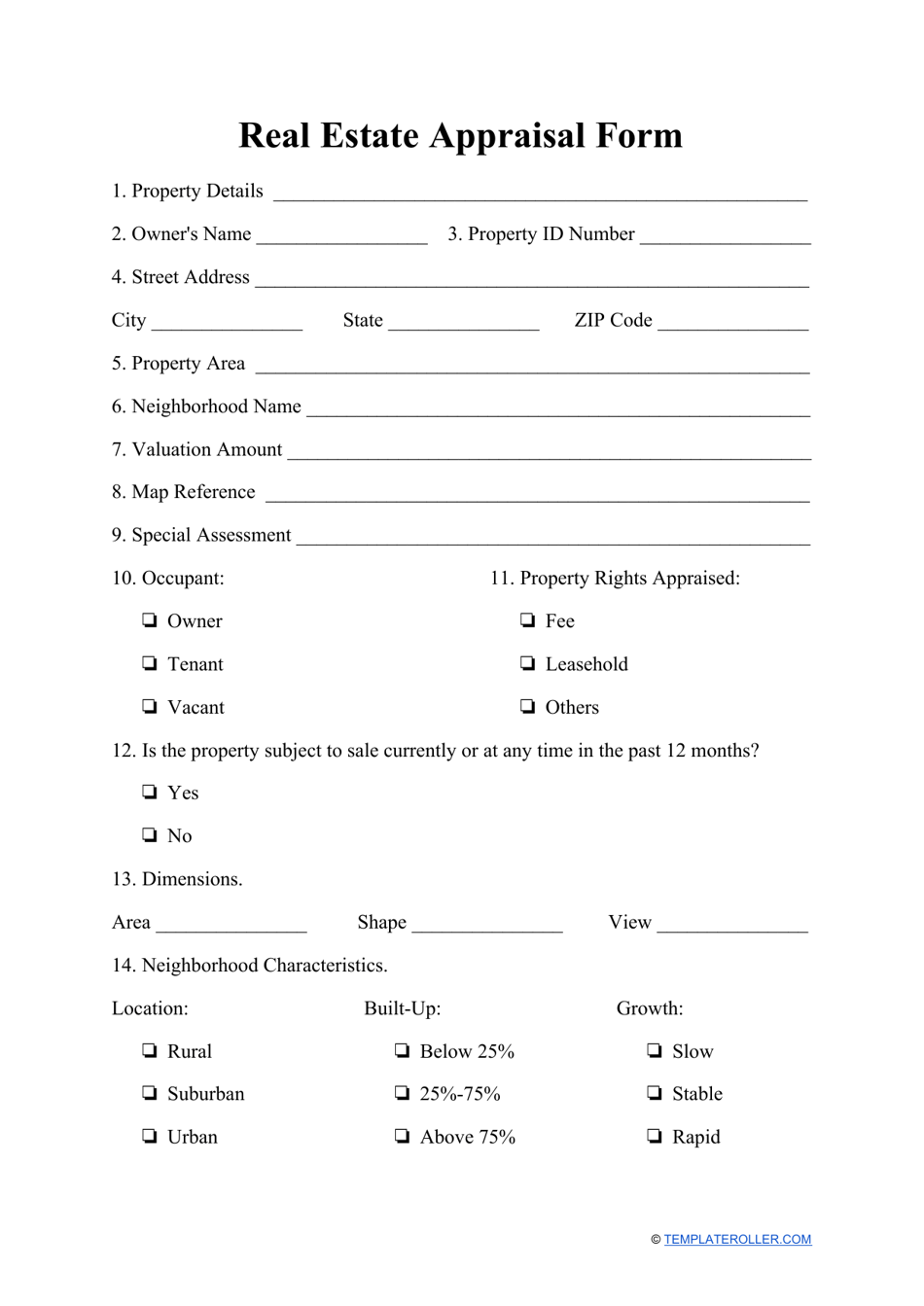

The lender wants to know that they are loaning funds to a property that is holding the stated value. A home appraisal is an objective and professional analysis of a home’s value. The report asks the appraiser to describe the interior and exterior of the property and the neighborhood.

What you need to know about filing a property tax appraisal protest - KBTX

What you need to know about filing a property tax appraisal protest.

Posted: Mon, 22 Apr 2024 23:37:00 GMT [source]

A home appraisal is a process through which a real estate professional determines the fair market value of a property. Home appraisals are typically required when you take out a mortgage, whether to purchase or refinance a house. The appraisal can assure you and your lender that the price you’ve agreed to pay for a home is fair. Pennymac’s online estimator is powered by a best-in-class Real Estate Automated Valuation Model (AVM). Despite this fact, our Home Value Estimator is not a substitute for an appraisal.

• The appraiser will also review things like the home’s location, quality of construction, parking situation, exterior condition, its age, its structure, the quality of the siding and gutters, and the square footage. Generally, an appraisal will be completed when someone is buying, selling, or refinancing a home. It will tell a homeowner whether or not the price they’re putting on the home is fair based on the condition of the home, its amenities, and its location. The most accurate home valuations are done by locally licensed, certified professionals. There is a charge for these and they take longer to complete, but they are able to account for a variety of different factors that can affect a specific property individually. When refinancing a mortgage, if the appraisal value puts your home equity at less than 20%, you’ll be required to pay for private mortgage insurance (PMI).

Accredited, professional team of experienced appraisers, researchers, and examiners trained to identify and value thousands of items. We produce USPAP-compliant reports as required by insurers, government agencies, and the courts. Thoroughly clean the inside and outside of the home, including the yard. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback.

Early on, a central building housed many workers and all the town’s businesses, including a “pool hall, a barber shop, post office, library, grocery and department store,” according to the Searles Valley Historical Society. Trona, a “desolate area that was very much thriving back in the ’50s and ’60s,” was littered with abandoned homes after plants closed decades ago, said Berri, 49. Now, “people are fixing them up and making the community better,” he said. Some of the state’s lowest median home values — as low as $114,000 —are located near the Oregon border, in the towns of Dorris, Macdoel and Tulelake. Each town is home to less than 1,000 people and set amid agricultural fields. These towns represent islands of affordability in a state where the median home price is $789,000.

Likewise, when a homeowner is refinancing their mortgage, the lender will have the home appraised to confirm its market value before extending a new loan. The typical home appraisal cost is $500, according to the 2023 Appraisal Survey from the National Association of Realtors. However, actual costs can vary widely and depend on a number of factors, including the size of the home and the metropolitan area its located in.

You can start by entering your address into Pennymac’s Home Value Estimator tool. If you need help finding a top local real estate agent, you can get help from Pennymac Home Connect and possibly earn a reward when you buy or sell with that agent. Bankrate.com is an independent, advertising-supported publisher and comparison service.

No comments:

Post a Comment